Flow Traders: How a Market Maker Turns Volatility into Profit

Analysing ETP growth and the strategic implications of Flow Traders’ 2024 capital expansion plan

This article is written by Ruofan Pi

Have you ever wondered how stock markets actually function?

When you click “buy” or “sell” on a trading app, your order executes almost instantly. But have you ever stopped to think: who’s on the other side of that trade? Who ensures there’s always someone ready to buy when you want to sell, or sell when you want to buy?

The Second-Hand Book Problem

Imagine you want to sell a textbook for £10, but no buyers show up. You face two unappealing choices: wait indefinitely for someone willing to pay your price or lower it until a buyer finally agrees.

The next day, your classmate urgently needs that same book and would happily pay £10. However, there are no sellers available. They must either wait or pay £15 for a new copy at the bookshop.

This is inefficient. Both of you lost out because you couldn’t find each other at the right time.

Here’s where the market maker steps in. A market maker acts as a middleman who is always ready to buy and sell, even when no one else is available. They appear with a simple offer:

“I’ll buy the book for £9.90, and I’ll sell it for £10.10.”

Now you can instantly sell your book for £9.90 instead of waiting or dropping your price to £7. Your classmate can instantly buy the same book for £10.10 instead of paying £15 at the shop.

The market maker earns £0.20 profit per book, but in return provides immediacy, liquidity, and price stability for everyone.

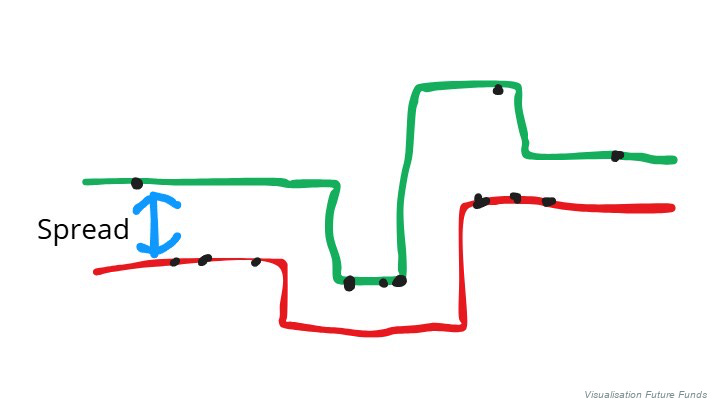

(Figure 1)

In financial markets, the same principle applies. The book represents a share. The market maker continuously quotes two prices: an ask (buy) price at the market’s highest, and a bid (sell) price at the market’s lowest. The difference between the two is called the spread, which is how they make money.

This is precisely what Flow Traders does, except instead of textbooks, they’re trading trillions of euros in financial products each year.

Introduction: What is Flow Traders?

Flow Traders is a leading global market maker specialising in Exchange-Traded Products (ETPs). Founded in 2004 and headquartered in Amsterdam, the company provides liquidity across multiple asset classes and instruments, including ETPs, futures, spot products, fixed income, currencies, and crypto assets.

At its core, Flow Traders is a liquidity provider, continuously quoting bid and ask prices to ensure the smooth functioning of markets. This continuous presence ensures that investors can execute trades efficiently without causing dramatic price swings. The firm employs sophisticated high-frequency and quantitative trading strategies to manage risk while generating profit from the spread between buying and selling prices.

For a market-making firm such as Flow Traders, success depends on three key elements: trading volume, market volatility, and trading capital. In essence, higher trading volumes, greater market volatility, and wider bid–ask spreads all contribute to higher profitability.

Higher trading volumes create more opportunities to capture the bid–ask spread, meaning that the more trades are executed, the greater the potential for revenue generation.

During periods of heightened market volatility, bid–ask spreads tend to widen as uncertainty increases. This environment offers more profitable trading opportunities for market makers but also raises risk, requiring sophisticated risk management to maintain stability during market distress.

Finally, the amount of trading capital deployed directly determines a firm’s capacity to seize opportunities. Greater capital allows for larger position sizes, broader market coverage, and the ability to provide liquidity across a wider range of products and markets.

The Explosive Growth of the ETP Market

The Exchange-Traded Products (ETP) market has experienced remarkable growth over the past two decades, and this expansion directly benefits market makers like Flow Traders.

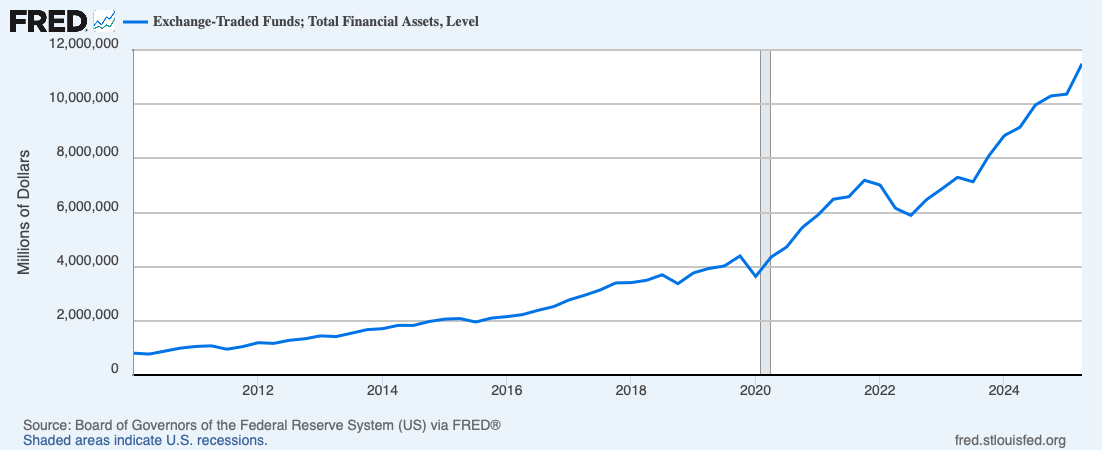

(Figure 2)

ETPs are investment vehicles that track an underlying index, basket of securities, or commodities. ETPs come in three main categories. Exchange-Traded Funds hold shares or bonds in proportion to an index. Exchange-Traded Commodities are designed to track single commodities or commodity indices. Exchange-Traded Notes are unsecured debt securities issued by banks with returns based on the performance of underlying securities. Despite their structural differences, all ETPs share similar advantages: they offer transparency, low management fees, minimal trading costs, and continuous intraday liquidity on secondary markets.

This sustained growth stems from fundamental shifts in investor preferences towards transparency, diversification, and efficiency. Perhaps most importantly, ETPs allow investors to gain exposure to markets that would otherwise be difficult or costly to access directly, such as emerging market bonds, commodity futures, or niche sector indices.

For Flow Traders, this structural growth translates directly into greater trading opportunities. The company now provides liquidity across more than 6,500 unique ETPs, representing over 40% of the global market.

The year 2020 was a defining example of this relationship. When the COVID-19 outbreak unleashed extreme volatility across global markets, investors rushed to rebalance their portfolios and manage risk through ETPs. While many financial institutions struggled with liquidity shortages, Flow Traders remained a reliable counterparty, ensuring that investors could buy and sell continuously, even as spreads widened. This period of intense trading activity and expanded spreads created ideal conditions for market makers.

The 2024 Capital Expansion Plan

To understand why Flow Traders made such a strategic shift in 2024, it is important to examine what happened in the years following its COVID-19 windfall.

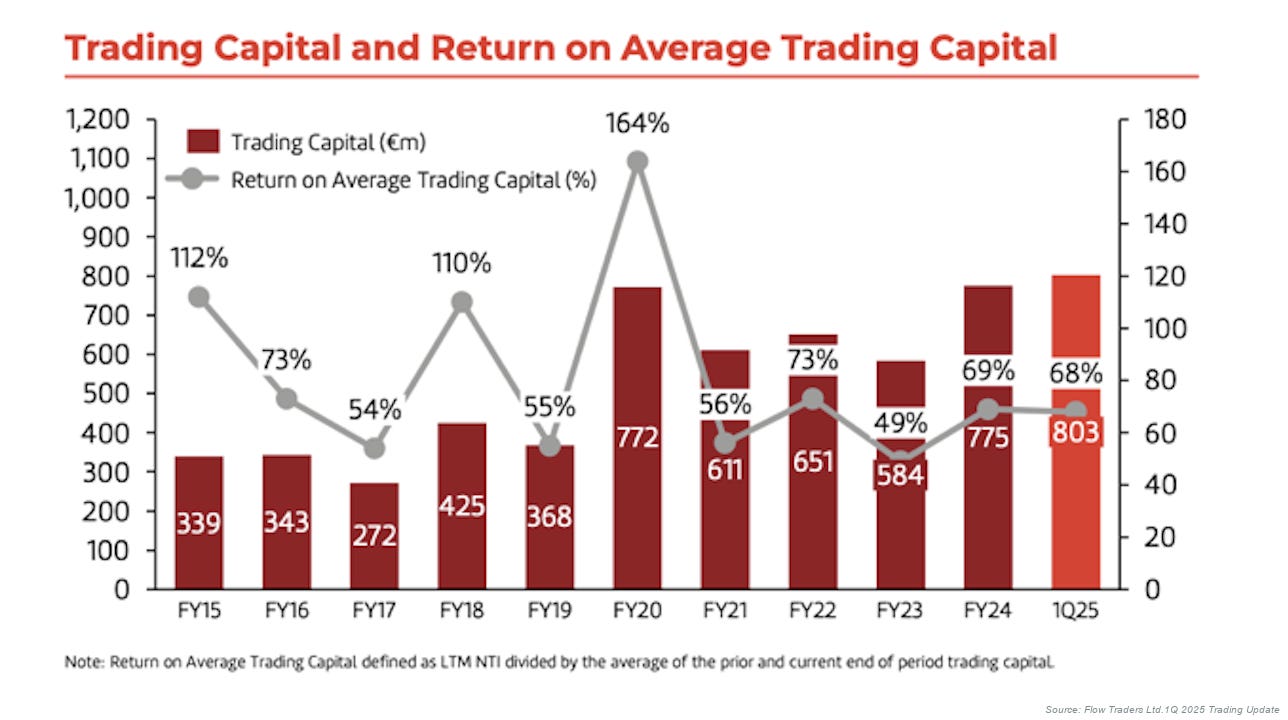

(Figure 3)

At the time, the company maintained a shareholder-friendly dividend policy, distributing substantial portions of its annual profits to investors. In FY2020, it achieved a remarkable 164% return on average trading capital, generating exceptional profits. However, after paying out dividends, the trading capital base began to shrink. From €772 million in FY2020, trading capital declined to €611 million in FY2021.

This diminishing capital base created a vicious cycle. With less capital to deploy, Flow Traders was unable to capture as many opportunities, even when market conditions improved. The return on average trading capital fell to 56% in 2021. The pattern was clear: the company was distributing the very resource that generated its returns, effectively starving its own growth engine.

Management eventually realised that trading capital is the lifeblood of the firm, the fundamental constraint on profitability. The company had been in a self-defeating loop, distributing capital that could have compounded at attractive rates if retained and redeployed. Retaining capital would allow Flow Traders to take larger positions, provide liquidity across more products, absorb temporary hedging losses, and fully participate in volatile markets where opportunities multiply.

This insight became particularly pressing as management observed the ETP market’s continued structural growth. Global ETP AuM were climbing towards record levels, institutional trading was expanding, and new asset classes such as digital assets were creating fresh opportunities. Yet Flow Traders found itself capital-constrained, unable to fully capitalise on the growth before it.

Therefore, in July 2024, then-CEO Mike Kuehnel and the Board implemented a decisive trading capital expansion plan. Regular dividend payments were suspended, and the dividend policy was amended to prioritise capital accumulation. Profits realised during the financial year were to be fully appropriated to increase and strengthen reserves.

Though Kuehnel stepped down in August 2025 to pursue a new opportunity, his successor, Thomas Spitz, has reaffirmed his commitment to this capital expansion strategy. This continuity in strategic direction signals that the capital retention policy will remain firmly in place for the foreseeable future.

The results were immediate. Trading capital grew by 33% over 2024, rising from €584 million to a record €803 million by the end of the first quarter of 2025, representing the highest level in the company’s history.

Company Valuation

The valuation of Flow Traders focuses on trading capital rather than earnings. Traditional Discounted Cash Flow (DCF) models were considered but ultimately deemed unsuitable for this analysis. For a market-making firm such as Flow Traders, a DCF approach would require estimating numerous complex inputs, including future trading volumes, volatility, bid-ask spreads, capital efficiency, and the cost of equity. Each of these variables fluctuates with market conditions, making reliable cash flow forecasting highly uncertain.

Instead, this analysis adopts a valuation multiple approach, similar in principle to a price-to-earnings (P/E) ratio, but based on trading capital. In Flow Traders’ case, trading capital is the key driver of profitability, the fundamental input that generates returns. The question becomes: what multiple should the market pay for each euro of trading capital, given the returns that capital can generate? This approach offers clarity by focusing on the stable, measurable input (capital deployed) rather than the volatile output (periodic earnings).

Our model constructs future valuations based on two critical variables: projected trading capital growth and the market’s valuation multiple of that capital. The methodology proceeds as follows.

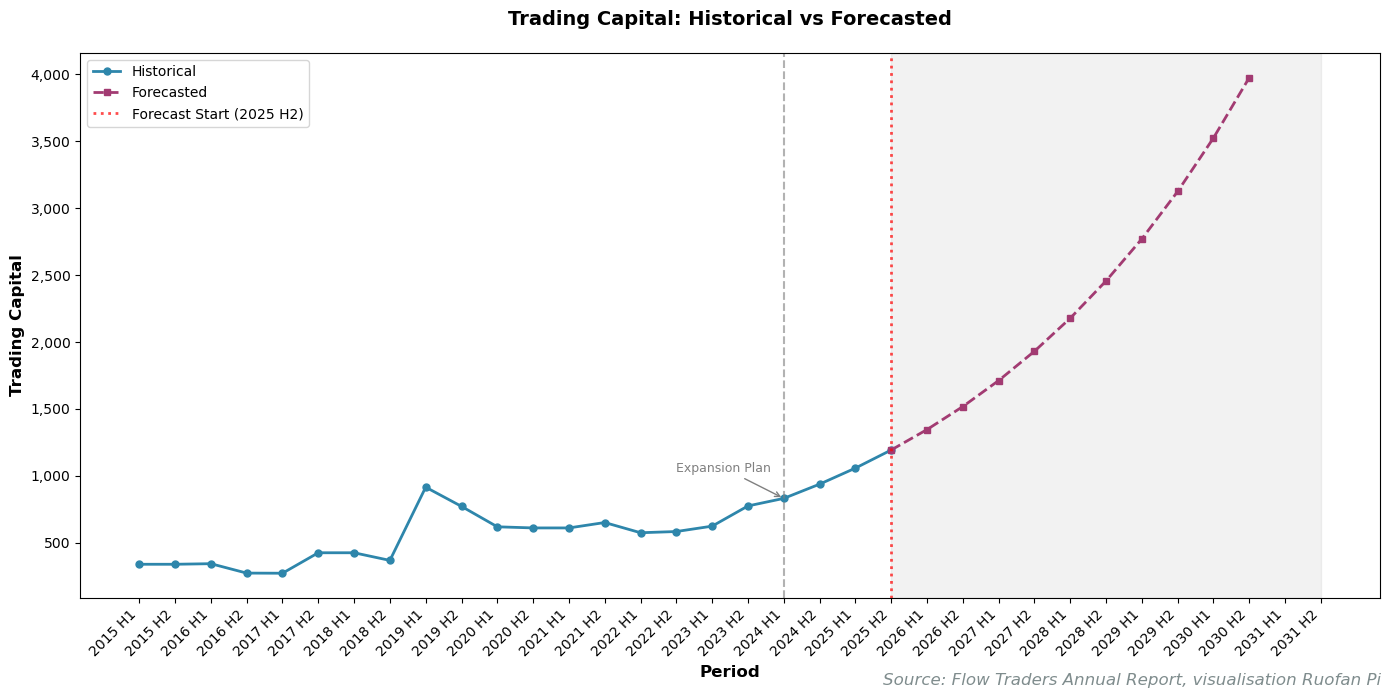

(Figure 4)

First, we establish a baseline growth rate for trading capital. Using data from the first half of 2024 through the first half of 2025, the period since implementing the capital expansion plan, we calculate the average half-yearly growth rate in trading capital. This period represents the most relevant baseline as it reflects the new dividend suspension policy and management’s commitment to capital accumulation. The observed growth rate is 12.79% per half-year during this period.

Applying the 12.79% half-yearly growth rate to Flow Traders’ current trading capital base generates a clear trajectory. From €831 million at the end of H1 2025, trading capital grows steadily each half-year, reaching almost €4,000 million by the end of 2031.

(Figure 5)

Second, we determine the appropriate valuation multiple for trading capital. By collecting stock price data corresponding to each financial reporting date that disclosed trading capital figures, we calculate the ratio of market capitalisation to trading capital. This metric represents the market capitalisation investors assign to each euro of trading capital.

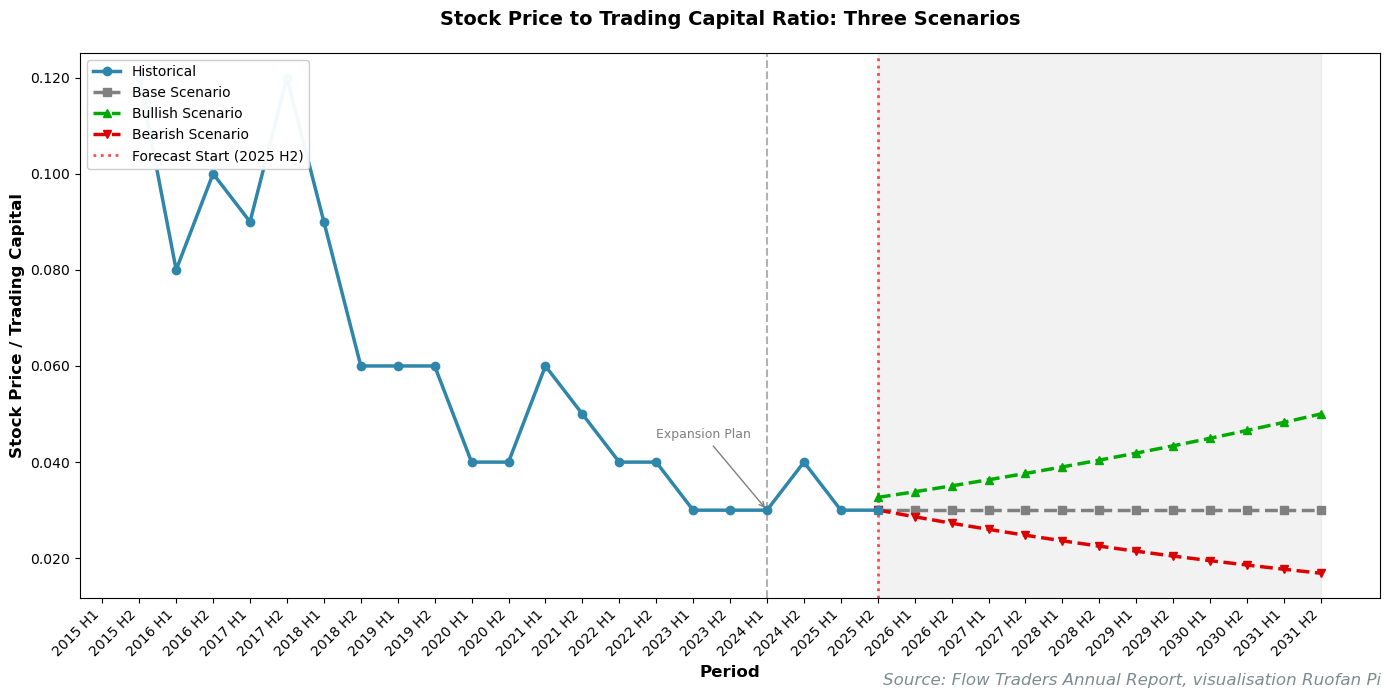

(Figure 6)

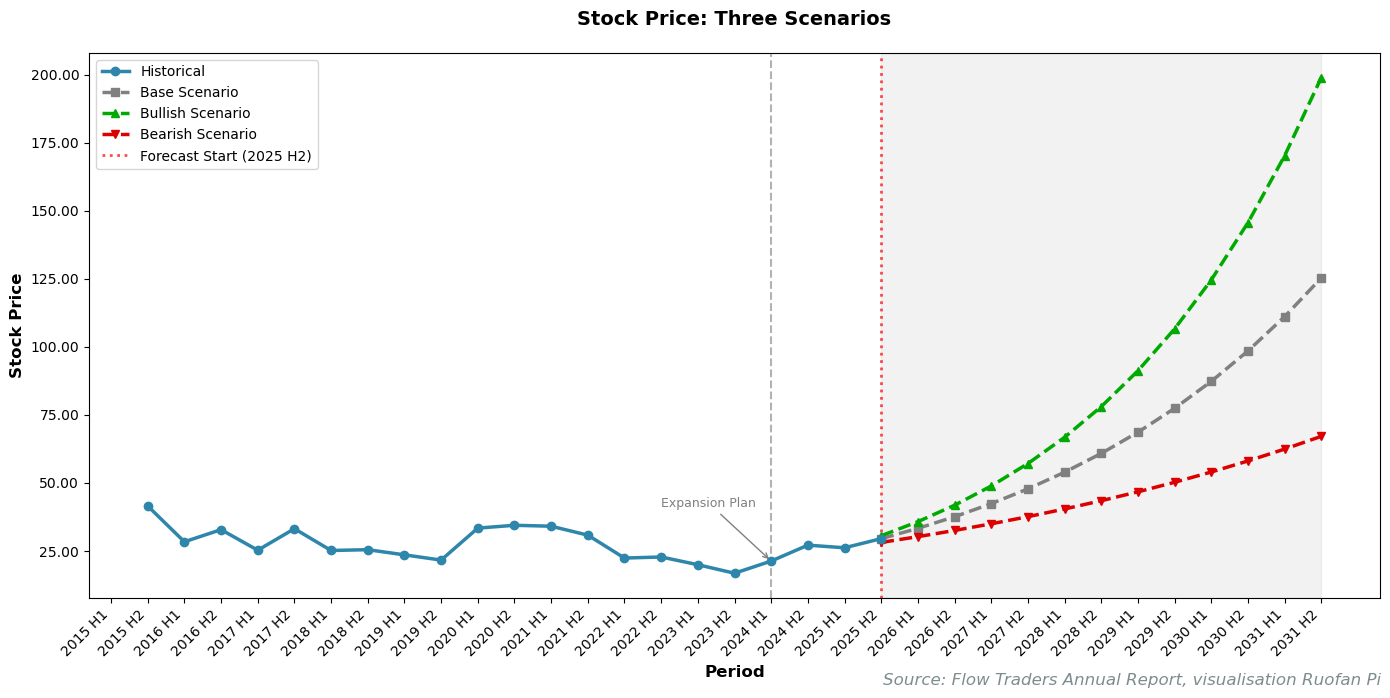

The behaviour of the stock price to trading capital ratio under different strategic outcomes forms the foundation of our scenario analysis.

Under our base scenario, we assume that this multiple remains relatively constant at its post-expansion average of 0.03. For market-making firms, this ratio should theoretically remain stable if the return on trading capital stays consistent. Unlike operating companies, where competitive dynamics can dramatically shift returns on invested capital, market makers operate in a more structurally stable environment. Bid-ask spreads may widen or narrow with volatility, but the fundamental economics of providing liquidity do not transform overnight. If Flow Traders maintains its competitive position and continues generating similar returns on trading capital, the market should continue valuing that capital at comparable multiples. Applying the 12.79% half-yearly growth rate in trading capital, this base scenario projects the share price reaching approximately €125 per share by the end of 2031.

The bullish scenario models a case where the new strategy not only accumulates capital successfully but also demonstrates improving capital efficiency. We apply the average growth rate of the stock price to trading capital ratio observed during the post-expansion period. The strategic shift from dividend distribution to capital accumulation, if executed effectively, could fundamentally enhance the quality of earnings and justify higher valuations. Under this scenario, the share price could reach approximately €199 per share by the end of 2031.

The bearish scenario assumes that the market fails to recognize the capital expansion plans benefits and keeps pricing the stock along its historic stock / trading capital ratio’s trend. We apply the average historical growth rate of the stock price to trading capital ratio from the pre-expansion period before 2024 H1. This declining ratio reflects the market’s historical valuation pattern when the company prioritised returning capital to shareholders rather than reinvesting for growth. Without the benefits of scale and with capital growth limited by dividend payments, the ratio would likely revert to its historical trajectory. Under this scenario, the share price would grow more modestly to approximately €67 per share by the end of 2031.

Competition

When evaluating Flow Traders’ prospects, it is essential to consider the broader competitive landscape of the global market-making industry. Key competitors include Jane Street, Optiver, and IMC, all leading proprietary trading firms with significant exposure to Exchange-Traded Products (ETPs) and some big banks. These competitors operate with similar high-frequency and quantitative trading strategies, providing liquidity across global markets.

Jane Street is widely regarded as the dominant force in ETP trading, particularly in the United States, where it consistently ranks among the largest liquidity providers for ETFs. Optiver, headquartered in Amsterdam like Flow Traders, has built strong positions in derivatives and ETPs across both European and Asia-Pacific markets. Compared with these larger and more diversified rivals, Flow Traders maintains a sharper focus on ETPs as its core business segment. This specialisation enables operational efficiency and expertise but also concentrates its risk exposure in a single product category.

Acknowledging these concentration risks, Flow Traders is diversifying into adjacent areas including connectivity, platforms, data, and tokens. Whilst these remain related to ETP trading, they represent an effort to build new revenue streams beyond pure market-making, mirroring the diversification strategies of larger competitors.

The competitive dynamic in ETP market-making remains intense yet structurally supportive. The continuous expansion of ETP listings globally means that multiple firms can coexist profitably. However, maintaining technological superiority, effective risk management, and access to deep trading capital are critical to preserving market share. Flow Traders’ recent capital expansion strategy can therefore be seen as a defensive and strategic response to the scale advantages of its larger peers.

Investment Implications

This valuation framework suggests that Flow Traders’ decision to prioritise capital accumulation could drive substantial value creation if the company maintains reasonable returns on its growing capital base. Unlike mature financial firms that struggle to deploy incremental capital productively, Flow Traders operates in a structurally growing market with clear capacity to absorb much larger trading capital than it currently possesses.

However, the investment case rests entirely on two variables: continued capital growth and sustained returns on that capital. Investors backing this thesis are essentially betting that Flow Traders can compound capital at high rates for an extended period without suffering competitive or regulatory setbacks. The five-year projection to 2030 represents a long runway during which numerous factors could disrupt the trajectory.

For investors comfortable with this volatility and uncertainty, the current valuation may offer attractive entry points if one believes in the structural growth of ETPs and Flow Traders’ competitive positioning. For those seeking more predictable returns or uncomfortable with earnings volatility, the stock likely remains too risky. The model provides a framework for thinking about valuation, but ultimately each investor must assess whether Flow Traders’ unique business model and strategic direction aligns with their portfolio objectives and risk tolerance.

indeed, trading capital may have grown on average 12.8% every 6 months during the 12(!) month period ranging from july 2024 to july 2025.

However, it does not make any sense to assume that trading capital will accordingly grow with same percentage for the next 5 years.

Really clear breakdown of the market maker's role and the critical link between trading capital and liquidity provision. It's a useful macro view of how liquidity is engineered in public markets. TCLM explores the parallel, operational side - how trade credit terms, receivables management, and working capital strategy function as the internal "market making" that determines a company's liquidity and cash flow resilience. Might be a helpful complement.

(It’s free)- https://tradecredit.substack.com/