ETFs, everything you have to know

What is it and what goes on under the hood?

All time high after all time high, the market keeps soaring, a lot of investors use ETFs to profit from this extraordinary market. Therefore it is the right time to dive into the mechanics of ETF investing as it becomes more and more popular. Should you limit your exposure to these financial assets, or is this actually a revolutionary tool which helps investors in a big way?

What is an ETF?

Think of an ETF, Exchange Traded Fund, like a shopping cart at the grocery store, instead of buying individual items (stocks) one by one, you can grab a pre-packed cart containing everything you need. A technology ETF, for instance, works just like buying a slice of the entire tech sector in one simple transaction.

The beauty of ETFs extends far beyond just stocks. Imagine wanting to invest in gold, traditionally, you'd need to figure out storage, security, and insurance. With a gold ETF, you can gain exposure to gold prices with just a few clicks on your trading app. The same goes for cryptocurrencies, institutional investors who previously couldn't touch Bitcoin can now directly invest through regulated ETF products.

What makes ETFs particularly attractive is their cost-effectiveness. Consider a scenario where you want to invest in the S&P 500, buying all 500 stocks individually would be incredibly expensive and time-consuming. An S&P 500 ETF accomplishes this with a single purchase, often charging less than 0.1% in annual fees. This revolution in investing has opened doors for average investors to build diversified portfolios that were once only available to the wealthy.

The mechanics are straightforward: when you buy an ETF share, your money goes into a fund that holds the actual assets. For example, if you invest $100 in a Nasdaq ETF, that money is pooled with other investors' funds to buy proportional shares in companies like Apple, Amazon, and Microsoft. You can trade these ETF shares just like stocks, selling when you need liquidity or buying more when opportunities arise.

Performance of popular ETFs

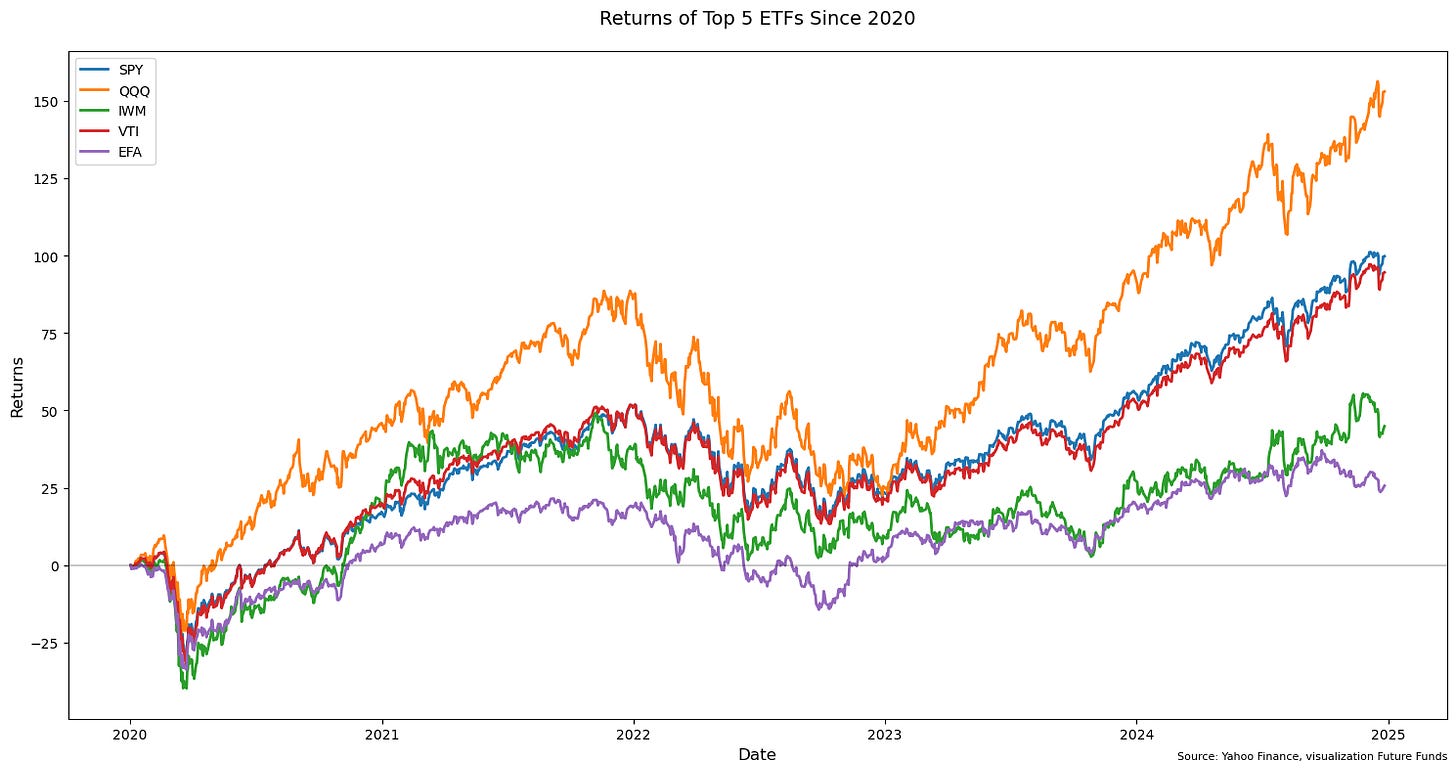

Figure 1 reveals the stock market performance since 2020 of the most popular ETFs. QQQ, dominated by tech giants, has soared over 150%, outpacing other indices substantially. While SPY and VTI (tracking the S&P 500 and total U.S. market) have delivered strong 100% returns, they've trailed QQQ's tech-driven surge.

The Russell 2000 (IWM), representing a basket of smaller U.S. companies like regional banks and emerging businesses, has struggled to keep pace. Unlike its large-cap counterparts, these smaller companies have not been able to keep up.

EFA, investing in developed markets outside the U.S., has delivered the weakest performance, highlighting American markets' dominance in recent years.

Figure 1

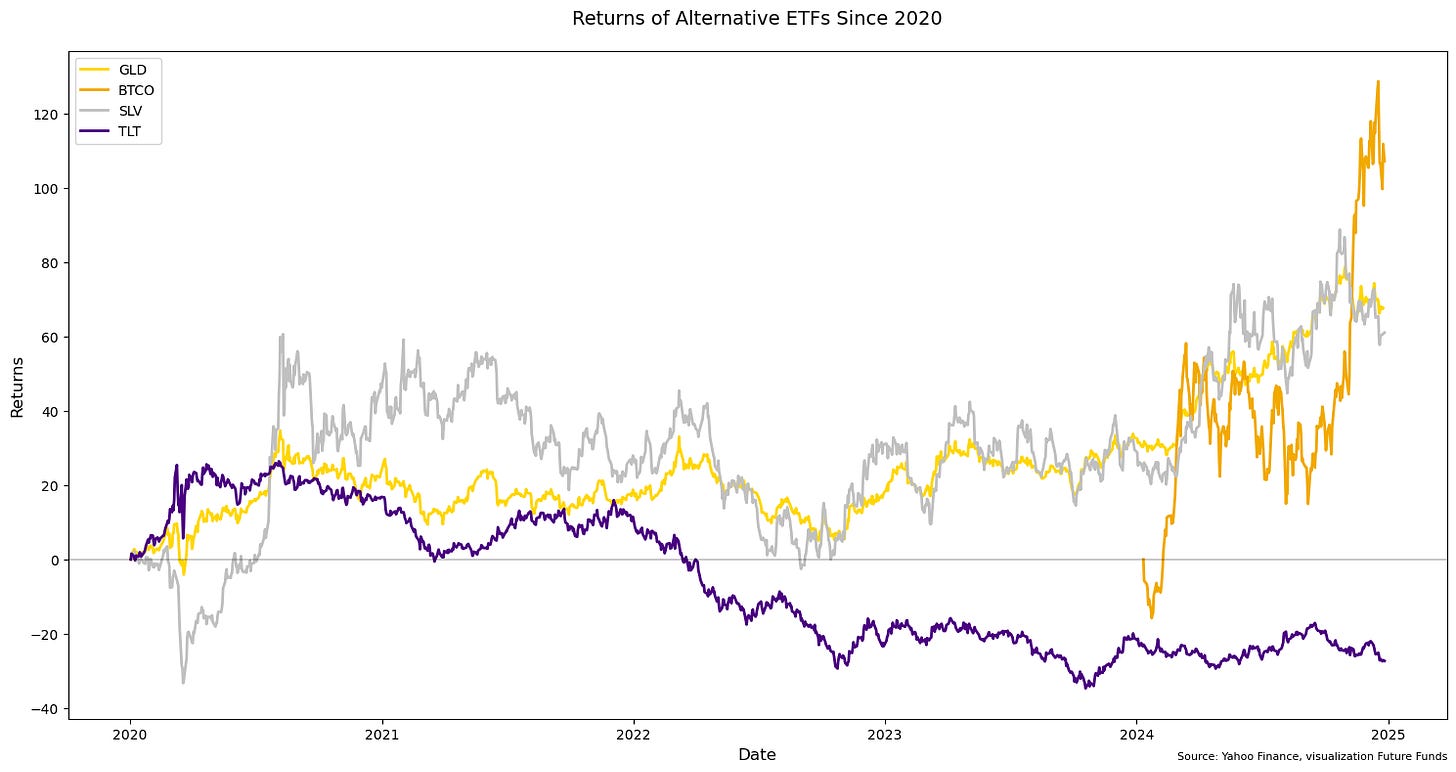

Figure 2 introduces alternative investments, with the spotlight on BTCO, the newly launched spot Bitcoin ETF. Its introduction marks a big moment, Bitcoin, previously accessible mainly through (sometimes dodgy) crypto exchanges, now trades alongside traditional assets like bonds and stocks.

Gold (GLD) and silver (SLV) have maintained their traditional role as stability anchors, while TLT (long-term Treasury bonds) has struggled amidst rising interest rates. This diverse performance across asset classes underscores why investors increasingly seek exposure across multiple ETF types, each offering distinct market exposure and potential diversification benefits.

Figure 2

Why do ETFs have the same value as their underlying?

Think about a currency exchange booth at an airport. They constantly update their exchange rates to stay close to the global market rate, if they didn't, someone could profit by buying currency from them and selling it elsewhere. In financial markets, market makers play this similar role for ETFs.

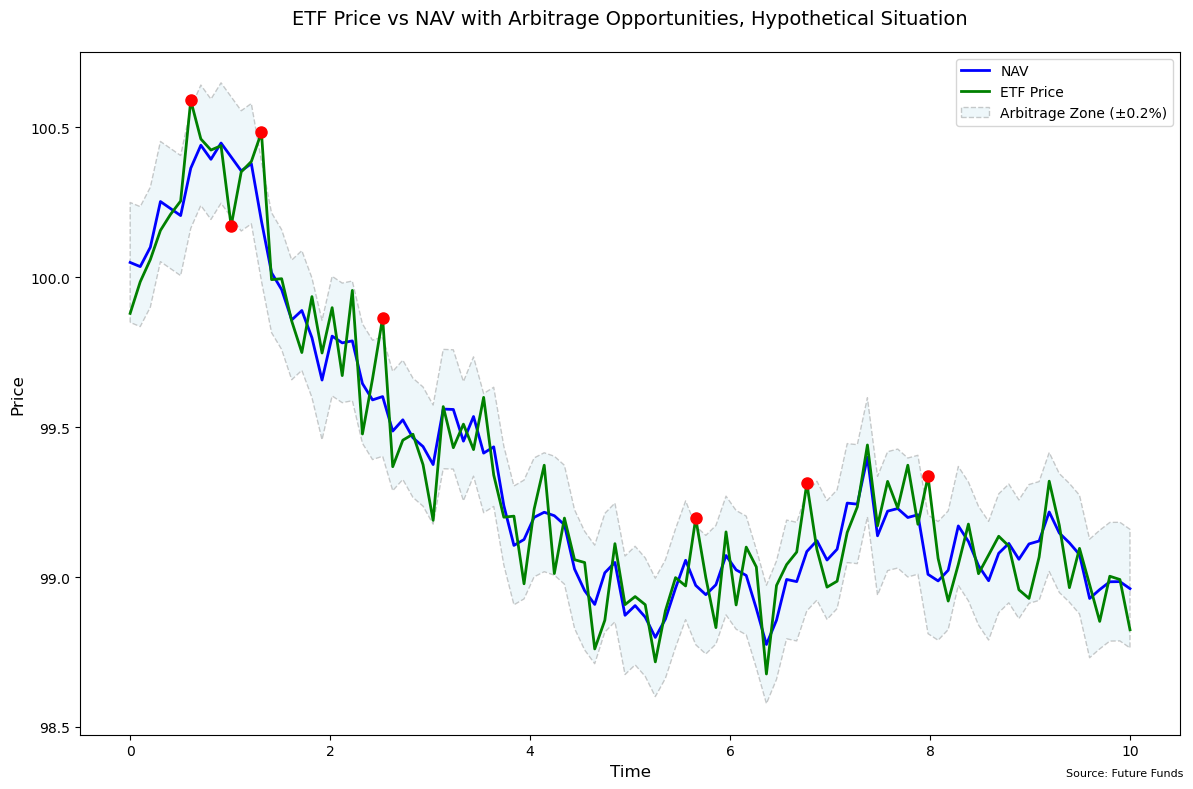

Looking at Figure 3, we can see this mechanism in action. The blue line represents the Net Asset Value (NAV) of the ETF's underlying holdings, while the green line shows the actual ETF price. Notice how these two lines generally stay within a narrow band (the shaded area) of ±0.2% of each other. This band represents potential arbitrage opportunities.

Figure 3

When the green line (ETF price) moves above the blue line (NAV) by more than 0.2%, market makers called Authorized Participants (APs) spot an opportunity. They can buy the underlying stocks at the lower NAV price and exchange them for new ETF shares, making a profit from the difference. The red dots in the figure highlight some of these potential arbitrage opportunities where the price deviation was significant.

Conversely, when the ETF trades below its NAV by more than 0.2%, APs can buy ETF shares and redeem them for the underlying stocks, again capturing the price differential. This continuous creation and redemption process keeps the ETF price closely aligned with its NAV.

The ±0.2% arbitrage zone shown in the figure is hypothetical and used for illustration. It's important to note that if transaction costs (like trading fees, bid-ask spreads, or other operational costs) amount to 0.2%, then price differences smaller than 0.2% might not actually represent profitable arbitrage opportunities. For example, if the ETF price is 0.2% above NAV but costs are 0.2%, then there is no potential profit.

Looking at Figure 3, we can see that while there are occasional deviations, the arbitrage mechanism generally keeps the ETF price (green line) tracking the NAV (blue line) quite closely. The largest deviations tend to be short-lived as arbitrageurs quickly step in to profit from and thereby eliminate these price differences.

This process makes ETFs more tax-efficient than traditional mutual funds because when market makers create or redeem ETF shares, they typically do so through "in-kind" transfers of securities rather than cash, resulting in fewer taxable events for ETF investors.

The constant activity of market makers through this creation and redemption process, as visualized in Figure 3, makes ETFs one of the most transparent and efficient investment vehicles available in modern financial markets. Their pursuit of arbitrage profits ensures that ETF prices stay closely aligned with their underlying assets, benefiting all market participants.

Why you should care

Most investors are aware of what an ETF is, but few understand the underlying mechanics that make them work. It is important when you own something to understand the players involved in making it a reality. ETFs offer benefits to small investors through diversification and low costs, making it possible to gain exposure to many different asset types with minimal capital required. As we've seen in Figure 3, the creation/redemption process ensures these investments remain efficient and closely track their underlying assets, a key feature that protects your investment and helps you build a robust portfolio.

Great post.

I’m fully invested in ETFs at the moment. As a lazy amateur investor I like the diversification opportunity they offer.

I’m planning to expand the portfolio with some stocks and create a sort of Core-Satellite portfolio to see how this plays out.

How would you compare the risks of investing in individual stocks vs etfs?