Why Stock Performance Doesn’t Tell the Whole Story: Is Novartis Nearing a Patent Cliff?

This article is written by Karl Rudolph

Introduction to Novartis

Novartis is one of the world’s largest pharmaceutical companies, driven by a mission to discover ways to improve and extend people’s lives. This mission is supported by a broad portfolio spanning multiple therapeutic areas, including oncology, immunology, and dermatology. The company develops drugs internally and strengthens its pipeline through acquisitions of intellectual property and patents from smaller biotechnology firms.

In recent years, Novartis has shifted its focus toward high-margin prescription medicines, reducing emphasis on generics and consumer health products. This strategic move emphasizes physician-prescribed therapies over over-the-counter products, positioning Novartis as a leader in innovative treatments. Understanding both the scientific and financial dimensions of the company is essential for evaluating its long-term stability and growth potential.

Historic influences on Novartis

Novartis’ legacy is deeply rooted in over a century of pharmaceutical innovation, originating from the merger of Ciba-Geigy and Sandoz in 1996. Historically, the company built its success on pioneering small-molecule and biologic therapies such as Gleevec for leukemia, Diovan for hypertension, and Lucentis for retinal disorders. These drugs not only defined Novartis’ scientific reputation but also generated substantial long-term revenue streams. However, as patents for these blockbusters expired throughout the 2010s, the company entered a period commonly referred to as a “patent cliff”, a stagnation or decline in revenue following the loss of market exclusivity. Once generic and biosimilar competitors entered the market, profit margins contracted rapidly, forcing Novartis to intensify its focus on new biologics and specialty drugs. This shift marks a transition from a historically chemistry-driven enterprise to a biotechnology-centered innovator. The company’s recent acquisitions, including Tourmaline Bio, can therefore be seen as part of a broader strategy to replenish its patent portfolio and mitigate recurring revenue erosion, while continuing to position itself at the forefront of high-value therapeutic innovation.

R&D Strategy and Investment

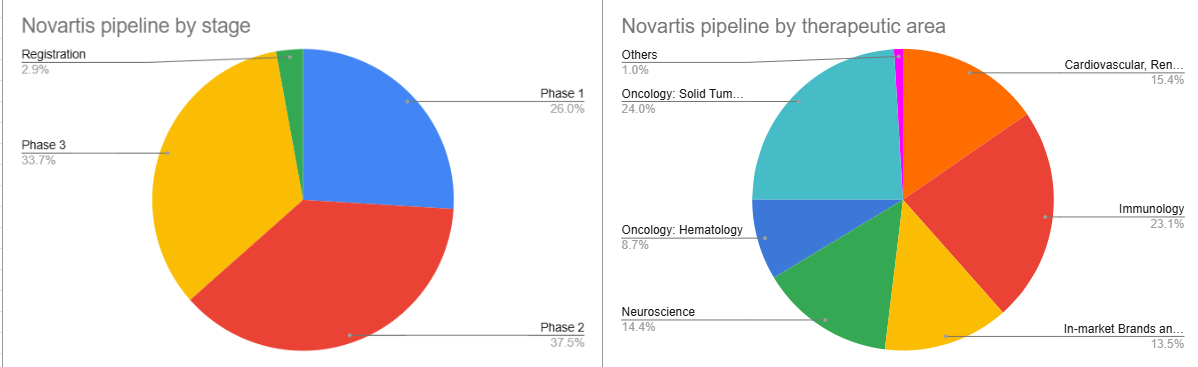

According to the 2024 financial report, Novartis invested approximately 10 billion USD in research and development. This substantial investment supports a pipeline of over 100 drug candidates across a wide range of therapeutic areas and development stages.

Figure 1

As shown in the company’s pipeline data, most candidates are already in late-stage clinical trials, where safety has been established and efficacy testing becomes the primary focus before market approval. The portfolio remains highly diversified, with oncology representing roughly one third of the total pipeline.

Key Drugs for future revenue

Cosentyx

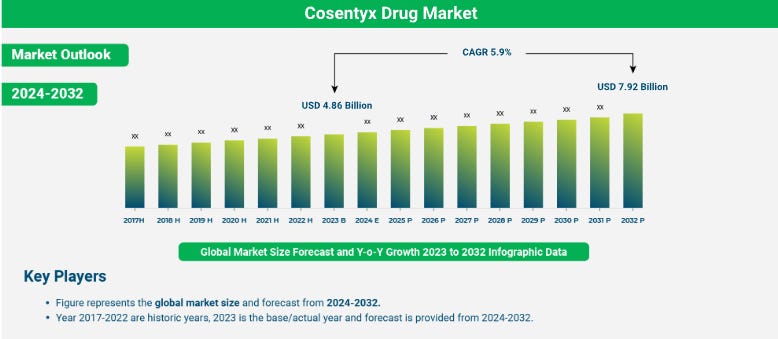

Cosentyx functions by inhibiting interleukin-17A (IL-17A), a cytokine involved in driving inflammatory responses at mucosal surfaces. It is primarily prescribed for psoriasis, psoriatic arthritis, and other chronic inflammatory skin or joint diseases.

Figure 2

The global Cosentyx market represents a consistent and reliable revenue source for Novartis [1]. Potential off-label applications such as rheumatoid arthritis or systemic lupus erythematosus could further expand its market potential prior to patent expiry. However, administration requires medical supervision due to possible side effects or contraindications with other biologics. After the initial supervised dose, trained patients may self-administer the drug, enhancing convenience and adherence.

Kesimpta

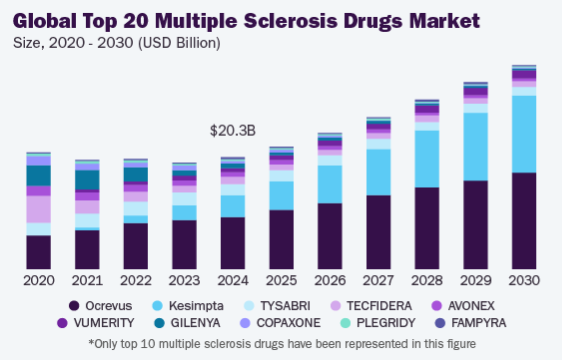

Kesimpta directly competes with Roche’s Ocrevus in the treatment of multiple sclerosis (MS). Both drugs target the CD20 protein on B-cells, reducing B-cell activity which is a key factor in slowing disease progression and relapse rates.

Figure 3

Currently, Ocrevus dominates the MS market. While Kesimpta’s patent extends to 2035, Roche’s patent for Ocrevus expires between 2028 and 2029 in the US and Europe. This may invite biosimilars that could disrupt pricing and erode Kesimpta’s market potential, limiting Novartis’ ability to fully capitalize on its patent protection [2].

Kisqali

Kisqali is a major player in the global breast cancer market, valued at around $26 billion, with over 50 percent of new prescriptions attributed to it [3]. It is effective in both early-stage and ER-positive breast cancer when used in combination with hormone therapy. Since 70–80 percent of breast cancer cases are ER-positive [4], Kisqali has the potential to address roughly three-quarters of the market. If prescriptions were to reach full potential, this could translate into approximately $20 billion in annual revenue, capturing a significant portion of the global breast cancer market. The drug selectively inhibits cyclin-dependent kinases 4 and 6 (CDK4/6), thereby preventing cancer cell proliferation. With patent protection extending until 2036 [5] and increasing clinical adoption, Kisqali is well-positioned to become one of Novartis’ highest-revenue products and a key asset in bridging future patent cliffs.

Novartis acquires Tourmaline Bio for ~1.4 billion USD

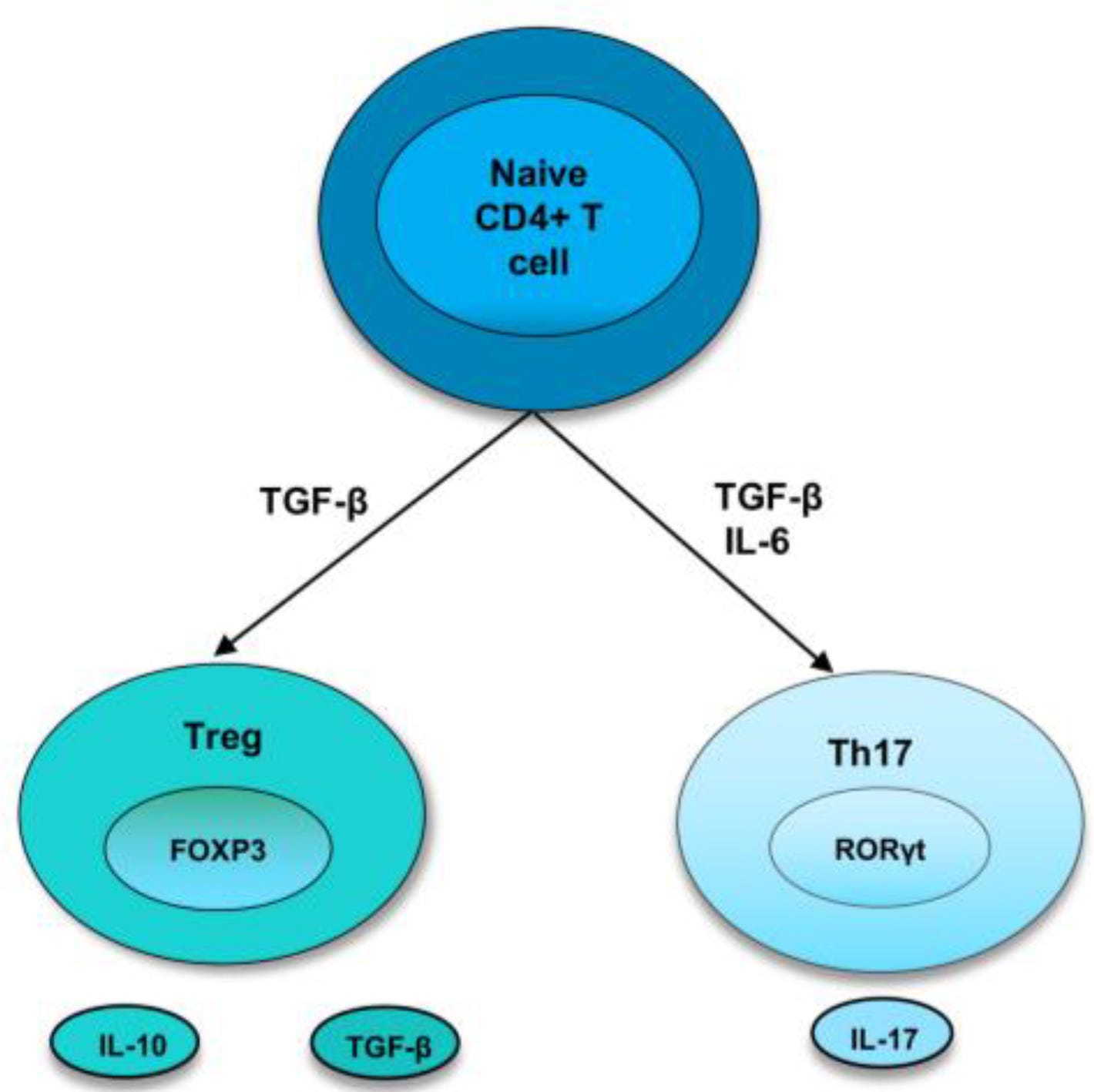

The acquisition of Tourmaline Bio strengthens Novartis’ pipeline. Tourmaline Bio currently has three drugs in development, with two in phase II clinical trials (https://substack.com/home/post/p-176847210). Its technology focuses on interleukin-6 (IL-6) modulation, a key cytokine in T-cell differentiation into Th17 cells. Th17 cells release IL-17, a driver of inflammation central to Cosentyx’s mechanism of action.

This acquisition opens the potential for Novartis to develop a dual IL-6 and IL-17 therapeutic, capable of selectively reducing IL-17–mediated inflammation. If successful, this could enhance Cosentyx revenue and expand Novartis’ capabilities in inflammatory diseases.

However, this potential must be approached cautiously. Phase III trials for the IL-6 blocking therapy are pending, and approval processes may take significant time. Combining it with Cosentyx, while potentially transformative, would likely extend timelines further. The global autoimmune disease market is valued at approximately $7 billion [6], highlighting that immediate commercial impact is not guaranteed.

Potential Impact of the Acquisition

Novartis’ acquisition of Tourmaline Bio presents a fascinating scientific opportunity, though its financial rationale appears less straightforward. The deal could help bridge Novartis’ upcoming patent cliff, yet the underlying economics of monoclonal antibody therapies make profitability uncertain without major advances in production efficiency.

Tourmaline’s IL-6–blocking monoclonal antibody represents a scientifically compelling approach to targeting key inflammatory pathways. However, with the average production cost of monoclonal antibodies around USD 100 per gram and treatment prices often reaching several thousand USD per gram, large-scale commercial viability remains challenging. In Tourmaline’s Phase 2b study, doses of 20 mg and 50 mg per patient per administration already translate into several hundred USD per patient raising concerns about commercial viability.

If Novartis were to successfully integrate Tourmaline’s IL-6 inhibitor with its existing IL-17 portfolio, it could theoretically command a significant portion of the inflammatory pathway landscape. Scientifically, that would be a breakthrough, financially however, it would depend heavily on pricing power and payer acceptance in an increasingly cost-sensitive market.

The global anti-inflammatory market, valued at approximately USD 133 billion in 2024 and projected to surpass USD 270 billion by 2034 [7], offers scale but also fierce competition and growing regulatory scrutiny over biologic drug pricing. Overall, this acquisition may prove to be a strategic research investment rather than an immediate financial win - scientifically ambitious, but economically uncertain.

The Patent Cliff and Financial Implications

At present, Entresto remains Novartis’ primary revenue driver. Its upcoming patent expiry poses a significant patent cliff, exposing the company to competition from generic alternatives. A transition towards Cosentyx as the main income source is expected; however, total revenue may decline in the short term as newer products like Kisqali and Kesimpta scale to Entresto’s revenue levels.

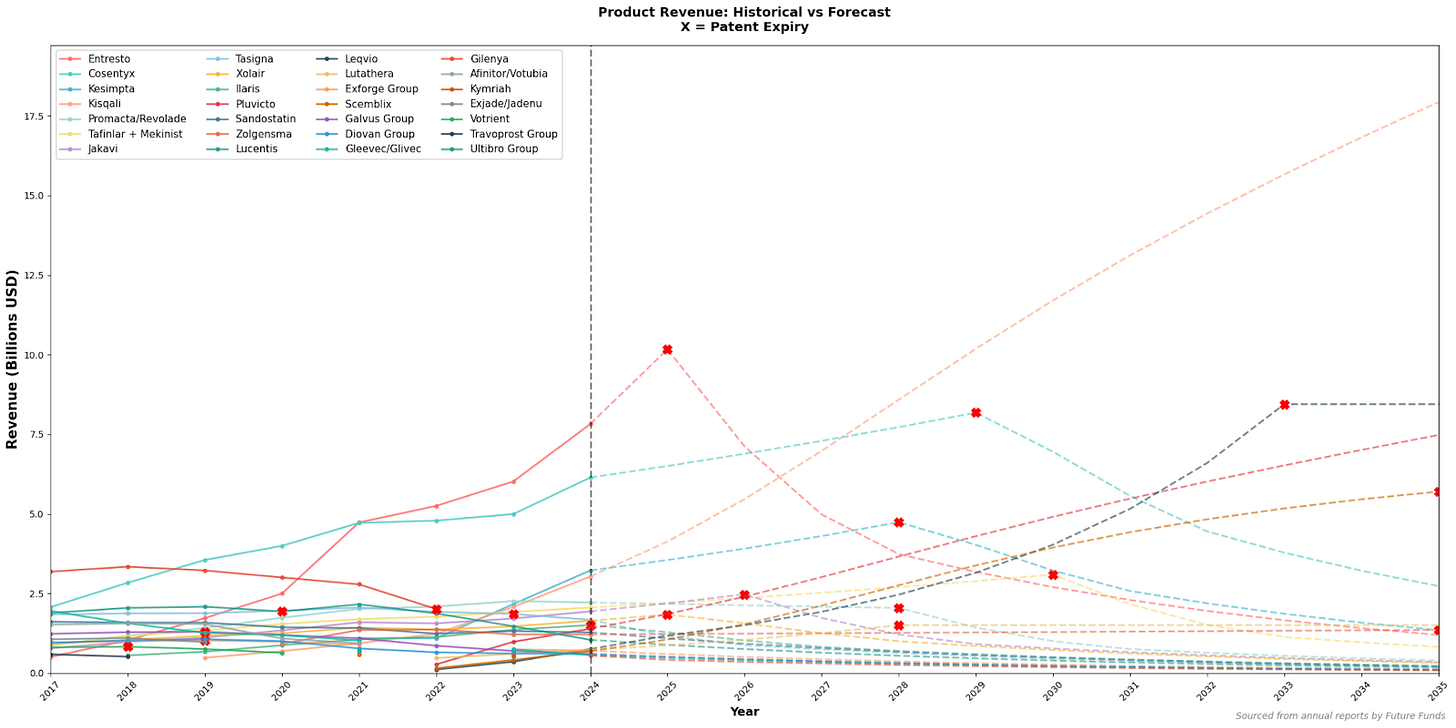

Figure 5, All products of Novartis - forecasted revenue (using historic growth rates)

This temporary income reduction could constrain R&D budgets, increasing the risk of future patent cliffs. While historical data suggest that Novartis’ diversified pipeline may mitigate this risk, such forecasts depend heavily on past performance. Therefore, scaling newer drugs like Kisqali rapidly is essential to maintaining both short-term financial stability and long-term innovation capacity.

Stock Performance and Pipeline Alignment

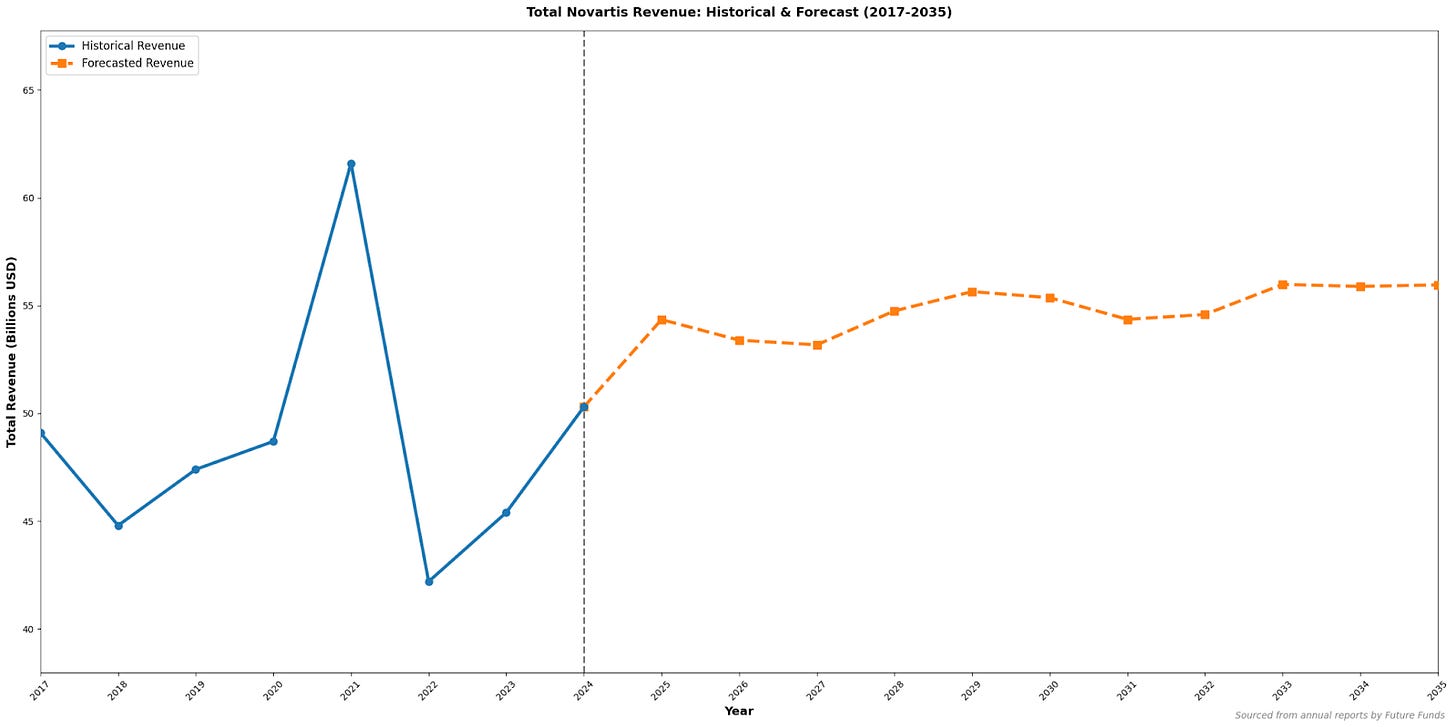

Investors often perceive Novartis as a stable and secure investment due to its steady stock performance. However, this apparent stability is closely tied to the company’s ability to continually replenish its pipeline with new blockbuster drugs before older patents expire.

Figure 6

Novartis’ business model effectively mirrors venture capital principles, continuously investing in high-risk, high-reward assets such as drug candidates while occasionally acquiring entire companies to secure promising pipelines. This approach highlights the importance for investors to look beyond financial metrics and understand the scientific and clinical foundations of a company’s assets to anticipate both short-term volatility and long-term growth potential.

Conclusion

Novartis continues to exemplify the balance between scientific innovation and commercial strategy. Its success depends on sustaining a dynamic pipeline, managing patent transitions, and maintaining strong R&D investment despite revenue fluctuations. The company’s shift toward advanced prescription therapies reflects its commitment to high-value innovation and long-term competitiveness.

Figure 7

For both investors and analysts, Novartis serves as a case study in how a deep understanding of science is essential for evaluating financial stability and future market potential. It also illustrates how crucial the balance between exceptional science, commercialisation, and strategic acquisition can be for a pharmaceutical company. Maintaining that balance in the coming years will be vital for Novartis to preserve its global leadership and avoid the full impact of the approaching patent cliffs.

References:

Great anlysis on Novartis' patent cliff challenge. Roche faces a similar dilemma but with a different twist since they've got both pharma (Ocrevus, Tecentriq) and diagnostics divisions creating some insulation that Novartis lacks. Their oncology pipeline is particularly strong with PD-L1 therapies and companion diagnostics forming a feedback loop that generates data advantages beyond just drug sales. While Novartis is betting on Kisqali and inflammatory disease franchises, Roche's diagnostics arm (Foundation Medicine acquisitions for $2.4B) gives them proprietary patient data that informs both drug development and test pricing power.