Before we dive into this week's article, I'd like to take a moment to connect with you, my valued readers. Your support through likes and subscriptions has been incredible, and if you haven't subscribed yet, I'd be grateful for your support. I'm also eager to hear your thoughts, what topics interest you most? Your suggestions will help shape future content and strengthen our community. Now, let's get straight to this week's article!

You want to start investing, you know that leaving your money in the bank is not the best option, but you also feel scared to pour your money into stocks or other risky financial assets. There is also an asset class that in general is considered less risky, these are bonds. Today I want to clarify to everyone what bonds are, what their potential risks are, and how you could use them to generate returns.

What is a bond?

A bond is a financial asset where you lend money to a company or government at a certain interest rate for an amount of time. You can simply see it as you lending money to a friend, after that you have to agree on a time that he pays this money back. Once you determine how much to lend, which is called the face value of a bond, you will need to determine how much interest will be paid and when these interest payments occur.

Let's say you lend money to a friend and he should pay the money and the interest on it on the same day at the end. This is called a zero coupon bond, contrary to a coupon bond where each period you already pay interest instead of the interest accumulating. The different moments cash is received from a type of bond with a face value of $1,000 and a 5% interest rate over 10 years is shown in Figure 1. You can see that a zero coupon bond with the same interest rate ends up with the borrower having to pay more in the end ($1,628 versus $1,500). This is because with a zero-coupon bond, the unpaid interest each year gets added to the amount owed, and you start earning interest on that accumulated interest, a concept known as compound interest.

Figure 1

What determines a bond's yield?

The yield you get from a bond is primarily determined by two factors, the risk-free rate and the risk of default. The risk-free rate is basically what you could get from lending to the safest borrower possible, typically set by central bank rates and government bond yields. Just like you'd want a higher interest rate from a friend who sometimes has trouble paying bills compared to your always-reliable friend, borrowers need to offer higher yields when there's more risk they won't pay you back.

This is why government bonds from stable countries like the Netherlands are considered practically risk-free investments, as the chance of the government failing to pay is extremely low. Companies, on the other hand, always have some risk of going bankrupt, so corporate bonds typically offer higher yields. For example, while a Dutch government bond might yield 3%, a corporate bond with the same maturity might yield 5% to compensate for the additional risk.

The forces behind bonds, the secondary market

While bonds seem straightforward if you hold them to maturity, the reality gets more interesting when we look at the secondary market, where bonds can be traded at any time. Let's break this down with a simple example:

Imagine lending money to your friend at 5% interest for 10 years. A week later, you discover your neighbor is lending at 6% for 10 years. This creates a problem if you want to sell your bond, why would anyone buy your 5% bond when they could get 6% from your neighbor? To make your bond attractive, you'd need to sell it at a lower price to compensate for the lower yield. This is how you can actually lose money on bonds in the short term through the secondary market, even though you'd still get your promised 5% if you held until maturity.

To understand how much bond prices change when yields move, we need to understand duration. Duration tells us the weighted average of when you get your money back from a bond. Think of it this way: if most of your money comes back quickly (like in bonds with regular coupon payments), the duration is lower. If you have to wait longer for most of your money (like in zero-coupon bonds where you get one big payment at the end), the duration is higher.

Looking at Figure 2, we can see two key things: First, when yields go up, bond prices go down (bad for bondholders) and vice versa. Second, and this is crucial, bonds with longer duration (like our 30-year line) see much bigger price swings when yields change. I've used zero-coupon bonds in this example since their duration is close to their time to maturity, making the relationship clearer.

Figure 2

A good option for the risk averse investor

For risk-averse investors, understanding interest rate movements is crucial for making informed decisions about the secondary market. This involves various factors, including inflation.

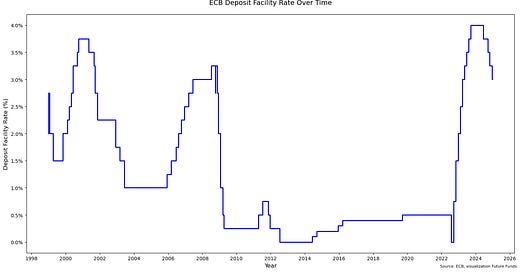

Figure 3

As seen in Figure 3, the ECB's deposit facility rate at which banks can deposit money is currently quite high, which translates into higher variable rates in the markets. For risk-averse investors, investing in variable rate bonds (floating bonds) could be a solid option as they offer protection against capital loss while providing better returns than traditional bank deposits.

Currently, allocating funds to variable-rate instruments is a reasonable strategy. While we appear to be entering a rate-lowering cycle, inflationary concerns could potentially reverse this trajectory. For risk-averse investors, it's still possible to benefit from higher interest rates. Consider exploring variable government bonds or ETFs (Exchange Traded Funds) such as FLOT (iShares Floating Rate Bond ETF) or SHV (iShares Short Treasury Bond ETF). When investing in variable rate bonds, you obtain the variable rate of that bond. There is minimal risk involving the secondary market as the yields change automatically. There is still default risk so it is important to always assess that. Remember, this is not investment advice, and your own due diligence is essential.

Why you should care

Understanding bonds is important as their dynamics are more complex than they initially appear. While this overview doesn't cover everything about bonds, it provides a solid introduction to bonds and their secondary market. If you want to invest but aren't ready for the stock market or want to diversify risks, bonds might be a suitable starting point now that you understand their basic principles and mechanics.

This is a great breakdown of bonds and how they work, especially for those new to investing. The explanation of the risks and how the secondary market impacts bond prices is really clear. I think it’s important for people to realize that bonds aren’t just "safe" investments, and understanding their dynamics, like duration and yield changes, can really make a difference. I’m curious, what are your thoughts on how the bond market will shift if interest rates continue to decrease over the next few years?