Europe's Job Market: A Continental Divide

The most difficult situation the european central bank faces

Picture this: two equally qualified software engineers, one in Madrid and one in Munich, both searching for work. Despite sharing the same currency and being part of the same European project, their job prospects couldn't be more different. This exemplifies one of the European Central Bank's greatest challenges, managing a single monetary policy for economies with vastly different labor markets. The 2008 financial crisis exposed these differences, with some countries bouncing back swiftly while others faced a lost decade of high unemployment, creating a divide in Europe's labor market that persists to this day. As we unpack the data, it will be revealed how these economic fault lines shape employment prospects across the Eurozone, from stable economies like Germany to nations still grappling with double-digit unemployment rates.

Unemployment in the countries with euro adoption

Before 2008, Eurozone countries moved largely in harmony, with unemployment rates following similar patterns despite their economic differences. Then came the financial crisis, shattering this unified picture in a dramatic fashion.

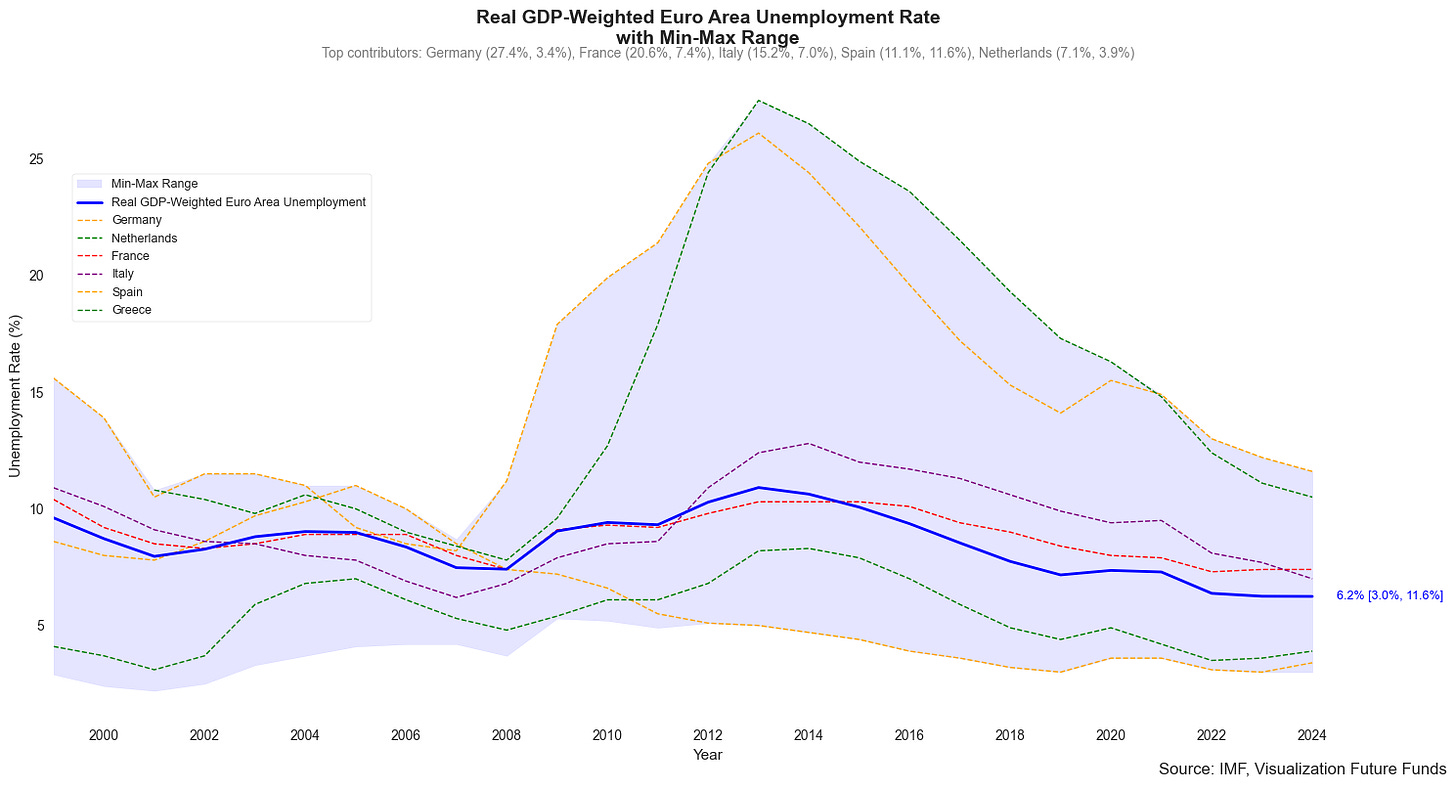

The divergence revealed in Figure 1 is striking. While some nations like Germany and the Netherlands maintained relative stability, others faced an economic whirlpool. Greece and Spain stand out dramatically, their unemployment rates soaring above 25%, levels unseen elsewhere in the Eurozone. This wasn't just a temporary spike; these nations found themselves trapped in a persistent cycle of high unemployment that would take years to begin unwinding.

This stark divide created a fundamental challenge for the European Central Bank: how to craft monetary policy that could simultaneously serve economies operating at such different frequencies. The data paints a picture not just of economic divergence, but of a monetary union facing unprecedented policy challenges.

Figure 1

The European average unemployment

Behind Europe's single currency lies a complex economic reality, one that emerges clearly when we look at unemployment through the lens of GDP.

Figure 2

Figure 2 reveals a clear economic hierarchy within the Eurozone. The continent's economic powerhouses maintain consistently low unemployment rates, while a distinct middle tier emerges with France and Italy tracking close to the Euro area average. The shaded range captures the full spectrum of unemployment rates, highlighting how economic strength correlates strongly with labor market stability. This pattern suggests that a country's GDP per capita isn't just a measure of wealth, it's a strong indicator of its labor market's fundamental resilience.

Figure 3

This GDP-weighted perspective gains additional depth when compared to the actual unemployment rate in Figure 3. Here, the red line represents the straightforward unemployment rate, the percentage of people without work across all Eurozone countries, while the blue line shows our GDP-weighted measure. The subtle but persistent gap between these two metrics hints at a deeper inequality, suggesting that the real experience of unemployment across Europe's population differs from what GDP-weighted calculations might indicate.

The divide between high and low GDP

To understand how differently the crisis affected rich and poor countries in the Eurozone, we can compare how unemployment rates look from two different angles.

Figure 4

Figure 4 shows the difference between two ways of measuring Eurozone unemployment. The first way is weighted by each country's population (what percentage of all Europeans are unemployed), while the second is weighted by each country's GDP (giving more importance to economically larger countries).

Before 2008, these two measures told a similar story, the difference between them was small. This suggests that unemployment was relatively similar across both rich and poor countries. However, during the financial crisis, these two measures began telling very different stories. The gap between them peaked in 2013, showing that countries with lower GDP per capita (like Greece and Spain) were experiencing much higher unemployment than wealthy countries (like Germany).

Even today, while this gap has shrunk, it hasn't returned to pre-crisis levels. This persistent difference poses a fundamental question for the European Central Bank: how can one monetary policy work for all when economic shocks affect rich and poor countries so differently?

Why should you care

Remember our two software engineers in Madrid and Munich? Their story perfectly captures why these unemployment patterns matter. The data reveals that where you live in the Eurozone can dramatically impact your job prospects, even within the same profession. When economic shocks hit, your location could mean the difference between stable employment and years of uncertainty.

This isn't just about individual careers, it strikes at the heart of the European project. A monetary union that produces such divergent employment outcomes challenges the promise of economic integration. For the European Central Bank, managing these inequalities while maintaining a single monetary policy remains a critical balancing act.

As we've seen, the divide between high and low GDP per capita countries isn't just a statistical curiosity, it represents real differences in economic resilience and recovery potential. How this difference is caused and how it can be solved is a challenging question that requires more in depth research, but unfortunately would also turn this 5 minute article into an entire master thesis. Understanding these employment challenges is essential for anyone working, investing, or making policy decisions in the Eurozone such as the European Central Bank.